Steady and Unstable? Insurance Premiums in 2024

Cyber insurance remains a hot topic for hoteliers. With increasing threats and brand requirements, what was once seen as a luxury item is now widely viewed as a necessity for proactive and prudent management companies.

Last year, we covered key aspects of the insurance market with a series of articles geared toward those new to the topic. If you missed them, read about fast facts, market changes, and a case study of the Marriott beach in our archive.

This month, the Echo is updating our coverage of the topic with information about the critical insurance issues of 2024—pricing trends, how to ensure you receive full coverage, and how investing in data protection can save you money during the process.

Let’s break out the crystal ball and see what’s in store for cyber insurance this year.

1. Maturing industry with more stable premiums

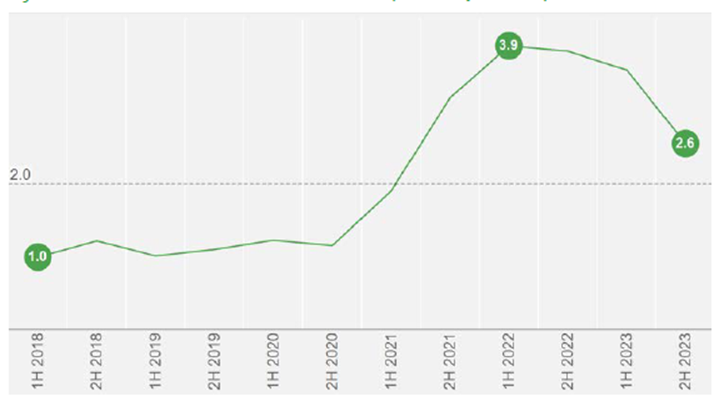

The cyber insurance industry was rocked by the 2020 pandemic and experienced an unexpected spike in the number of claims and reported damages. This, combined with inherent difficulties in pricing insurance products in novel and emerging markets, caused premiums to soar. The industry reported 50%+ increases in 2021 and 2022.

In the last year, the industry has matured, investing in new resources to accurately model and underwrite cyber risk. This has resulted in premiums stabilizing and even beginning to fall:

Source: Woodruff Sawyer Annual Clients Renewals

2. … and requirements.

The maturation of cyber insurers has also led to increasing standardization and codification of underwriting requirements. 2024 is shaping up to be a year in which insurers expand their rules for organisational data protection and security measures.

Already, insurers required core measures like MFA, security awareness training, and patch management systems. Look for rules to expand into the following areas:

*Incident response planning

*Identify and access management (IAM)

*Backups and disaster recovery

*Partnership with a managed security provider (MSP)

Getting the right policies in place is essential to stay ahead of the trend and, for those with coverage, ensure that you’ll receive a full payout when filing a claim.

3. Acts of War

War!? What does that have to do with our business?

Well, expect insurance companies that do lower their premiums to maintain their bottom line by offsetting those changes with new policy exclusions.

Recently, the pharmaceutical giant Merck ended a multi-year legal battle with insurers who claimed that its 2017 breach executed by a Russia-linked ransomware gain was an “act of war” and thus exempt from coverage.

Though far from the front lines, the major ransomware gangs, including those who have recently set their sights on hospitality, have close ties with state sponsors.

It is possible that insurers, faced with steep losses in the event of catastrophic attacks, could attempt to exploit this “loophole” to avoid a payout.

Other potential exclusions include:

*Retroactive dates. Dates after which events that have taken place in the past but are discovered later are no longer subject to coverage.

*Acts of terrorism.

*Jurisdiction. Location or national place of coverage.

*Property damage, including replacing “bricked” equipment.

Feeling overwhelmed? Don’t be. VENZA is here to help. Cybersecurity is complex, but in partnership with us, your company can get started in as little as one month. Get a live demonstration today by contacting our Customer Success Team.

Ready to elevate your game? Contact Sales to discuss signing up for our programs or adding new solutions to your contract.

***

Take VENZA’s free Phishing Test to assess gaps in your human firewall today!

Training your personnel to recognize and report phishing attempts is essential to protecting your guests and their data. Get started by determining your risk and readiness level using this free tool.

***

Want to stay informed? Subscribe to the free VENZA Echo now. You’ll receive a monthly digest with the highlights of our weekly article series and important product updates and news from VENZA.